The Power of Oracle Narrative Reporting

When businesses search for oracle narrative reporting, they’re looking for solutions to make their financial and management reports more meaningful. This powerful Oracle Cloud EPM tool helps by:

- Combining data with text: It brings numbers and written explanations together.

- Streamlining report creation: It offers a secure, step-by-step process.

- Enhancing collaboration: Teams can work together on reports more easily.

- Meeting reporting needs: It helps publish reports for internal and external use.

Many companies struggle with financial reporting, spending most of their time gathering data. This leaves little opportunity to explain what the numbers mean. In fact, 90% of companies agree that adding qualitative commentary is critical, but they lack the time. Oracle narrative reporting, a key part of Oracle’s Enterprise Performance Management (EPM) suite, solves this problem. It transforms how organizations create and share reports by helping you tell the full story behind the numbers, providing context and insight that goes beyond raw figures.

I’m Louis Balla, CRO and partner at Nuage. With over 15 years in digital change, I’ve seen the challenges teams face optimizing tools like oracle narrative reporting within a NetSuite environment. My work focuses on helping businesses maximize their NetSuite investment by bridging the “NetSuite Divide” through strategic alignment and integrating third-party applications for comprehensive reporting that goes beyond the numbers. Learn how we help businesses optimize their NetSuite experience at https://nuagecg.com/netsuite/.

Basic oracle narrative reporting terms:

What is Oracle EPM Narrative Reporting and Why Does it Matter?

At its core, Oracle Narrative Reporting is a specialized tool within Oracle Cloud EPM designed for creating management, narrative, and regulatory reports. It handles the “last mile” of finance—the critical final step where raw financial data is transformed into clear, understandable, and useful reports that tell a story.

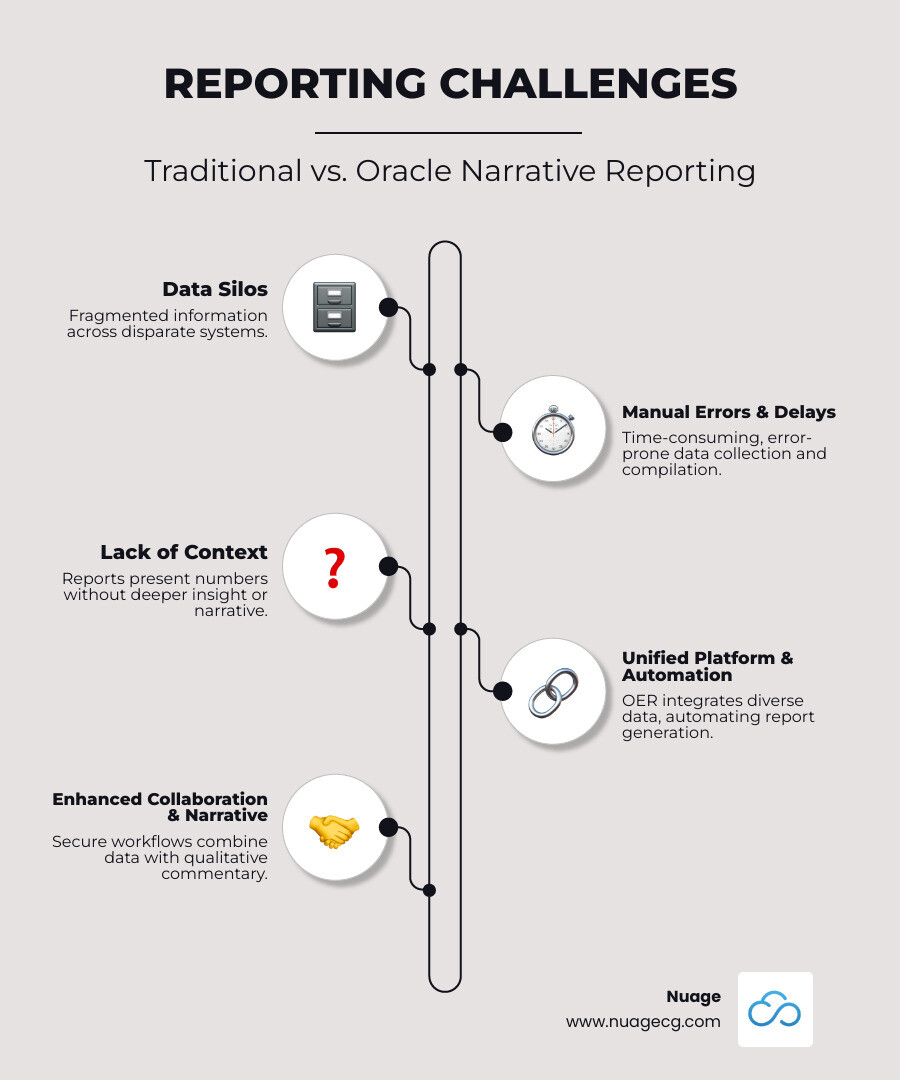

This “last mile” is crucial because it’s where numbers gain meaning. Without context, even accurate data can be misunderstood. Traditional reporting is often a manual, time-consuming process with scattered data, leading to inconsistencies and reports that are just a pile of numbers. Oracle Narrative Reporting fixes this by offering a secure, team-based, and process-driven way to author, review, and publish reports. It establishes a single “source of truth” that unifies numbers and narrative.

Let’s see how Oracle Narrative Reporting stands out from older reporting methods:

| Feature | Traditional Reporting | Oracle Narrative Reporting |

|---|---|---|

| Process | Manual, improvised, time-consuming | Automated, process-driven, efficient |

| Data Flow | Siloed, often disconnected | Integrated, unified, real-time |

| Collaboration | Disjointed, email-based, version chaos | Secure, role-based, version-controlled |

| Output | Static, numerical, lacks context | Dynamic, contextual, insightful |

| Accuracy | Prone to manual errors, inconsistencies | High accuracy, data validation built-in |

| Compliance | Manual checks, difficult to audit | Streamlined, auditable, regulatory-ready |

This change allows a move from stressful, manual reporting cycles to a smarter, more insightful approach. Want to dive deeper into how we help make finance processes smoother? Check out our insights on Financial Planning and Analysis services.

The Problem It Solves: Beyond Raw Data

The biggest challenge Oracle Narrative Reporting tackles is companies spending nearly all their time gathering data, leaving no time for analysis. As mentioned, 90% of companies agree that adding explanations is key, but this step is often skipped. Raw numbers can be misleading without context. For example, a revenue increase sounds great, but the story behind it—whether it was a strategic plan, a market shift, or a one-time event—is what provides real insight. Without this narrative, different teams can share conflicting reports, causing confusion and eroding trust in the data. Oracle Narrative Reporting closes this gap by connecting hard numbers with the insights that drive understanding. For more on this topic, an external article on Evaluating Narrative Evidence in Financial Reporting is very helpful.

How It Transforms the Reporting Cycle

Oracle Narrative Reporting is a complete system that redefines the entire reporting process, from initial concept to final publication, bringing significant efficiency and control.

Here’s a quick look at how it works:

- Defining: You start by setting up the report’s structure, data sources, and workflow. This upfront planning ensures everyone is aligned from the start.

- Authoring: Team members can work on different parts of the report simultaneously. They can pull data directly from source systems, add charts from Excel via SmartView, or write narrative explanations, all while working on the latest version.

- Reviewing: Drafted sections enter a clear review process. Reviewers can add comments and suggest changes directly within the platform, eliminating confusing email chains and version control issues.

- Publishing: Once approved, the final report can be published in various formats, ready for internal use or regulatory filings in a smooth, secure, and traceable process.

This streamlined workflow, combined with strong version control, dramatically reduces report creation time, allowing for faster delivery of more accurate information to stakeholders. Why not Take a quick tour of the platform yourself?

Core Capabilities of Oracle Narrative Reporting

The power of oracle narrative reporting comes from its core capabilities, which transform complex corporate reporting into a manageable and insightful process. At Nuage, our work with Budgeting and Planning Software highlights the need for strong narrative reporting to effectively communicate financial plans.

Key capabilities of oracle narrative reporting include:

- Data Integration: Connects with sources like Oracle EPM Cloud, Oracle Cloud Financials, Hyperion systems, and NetSuite ERP. It also allows importing from Microsoft Word, PowerPoint, PDF, and Excel, reducing manual entry and improving reliability.

- Secure Collaboration: Enables multiple users to work on a report simultaneously in a structured environment with defined permissions to keep sensitive information safe.

- Automation: Automates data refreshes, content rollovers from previous periods, and review processes, saving time and reducing human error.

- Regulatory Compliance: Supports formats like XBRL/iXBRL, Country-by-Country Reporting (CbCr), and ESMA ESEF to simplify compliance.

- Data Reliability: Ensures numbers and narratives are accurate and consistent by connecting directly to source systems and using built-in validation checks.

Fostering Secure Collaboration and Workflow

Effective collaboration is central to oracle narrative reporting, which uses “report packages” and “doclets” to manage the process. A report package is the container for an entire report (e.g., an annual report), while doclets are the individual sections or chapters within it.

The system manages workflow through defined roles:

- Owners: Oversee the entire report package and process.

- Authors: Create content for assigned doclets.

- Reviewers: Add comments and suggest edits on drafted content.

- Approvers: Provide final sign-off on doclets or the full report.

- Viewers: Can see finished reports but cannot make changes.

This granular control secures data and provides a complete audit trail of all changes, comments, and approvals, ensuring transparency and accountability.

Seamless Integration with Your Data Ecosystem

A key feature of oracle narrative reporting is its ability to connect with a wide range of data sources, creating a single source for all reporting. As a core part of Oracle EPM Cloud, it works seamlessly with other EPM tools. Its integration capabilities extend to:

- NetSuite ERP: For our clients using NetSuite ERP, this integration is a major advantage. Financial and operational data can be pulled directly from NetSuite, ensuring consistency. This is invaluable for companies using NetSuite as their core system, as it combines data and commentary without manual work. Our expertise in NetSuite ERP Implementation ensures these connections are robust.

- Oracle Analytics: Connect to Oracle Analytics to embed rich data visualizations into your reports.

- Microsoft Office Integration (SmartView for Excel): SmartView allows you to embed live, refreshable data from EPM applications directly into Word, PowerPoint, and Excel. Financial models in Excel can automatically update within your narrative report, keeping data consistent and reducing manual effort.

- Native Databases: Connect to various other databases for additional data sources as needed.

This broad integration ensures you are always working with the most current and reliable data.

The Future is Now: AI’s Role in Enhancing Reporting

Artificial Intelligence (AI) is beginning to improve oracle narrative reporting by helping to tell the story behind the numbers. Generative AI is ready to automate the creation of narrative summaries based on underlying data. Imagine AI drafting initial commentary, identifying and describing data anomalies, suggesting root causes for variances, and generating text that explains trends over time. While human oversight remains critical for strategic insight and accuracy, AI’s role is to augment human capabilities, making the reporting process faster and smarter, and allowing finance professionals to focus on high-value analysis.

From Board Books to Regulatory Filings: Key Use Cases

A key strength of oracle narrative reporting is its versatility. It’s not a single-task tool but a comprehensive solution that handles a wide range of reporting needs, from detailed internal reviews to stringent external regulatory submissions. At Nuage, we know every report has a unique purpose, and this tool’s flexibility provides a significant advantage. Effective reporting is a cornerstone of a smart financial strategy, a topic we often cover in our insights on NetSuite Financial Planning.

Let’s explore some key use cases for oracle narrative reporting.

Internal Management and Performance Reviews

These reports are vital for internal decision-making, giving leadership a contextualized view of business performance. Oracle narrative reporting is ideal for creating comprehensive Board Books that combine financial data with operational metrics and strategic commentary. It can also produce targeted Business Briefing Documents for specific departments, detailed Divisional Performance Reviews to analyze subsidiary performance, and Project Updates that track financial spend against milestones. For major investments, Capital Project Reporting can monitor progress by pulling data from multiple systems. The platform’s collaborative features allow departments like finance, operations, and sales to contribute seamlessly to a single, holistic report.

External and Regulatory Reporting

For external stakeholders and regulators, precision and compliance are non-negotiable. Oracle narrative reporting is designed to simplify these complex requirements. It’s used to produce polished Annual Reports that integrate audited financial statements with Management Discussion and Analysis (MD&A) and ESG disclosures, as well as concise Shareholder Reports focused on key performance indicators.

For public companies, the platform helps produce compliant SEC Filings. Its built-in XBRL/iXBRL Support is critical for meeting regulatory mandates, allowing users to manage taxonomies and publish in required formats like SEC EDGAR HTML and ESMA ESEF. This feature simplifies the complex process of tagging financial data. For multinational corporations, tax filings like Country-by-Country Reporting (CbCR) can be managed efficiently within the platform to ensure compliance across jurisdictions.

A Strategic Guide to Implementation and Best Practices

Implementing oracle narrative reporting is more than a technical setup; it’s a strategic shift in how your organization approaches financial storytelling. A successful implementation, guided by a clear process flow, can become a competitive advantage, leading to faster insights and greater stakeholder trust. Our experience as NetSuite ERP Consultants shows that this upfront investment in process and design pays long-term dividends.

Best Practices for Effective Oracle Narrative Reporting

Following proven best practices is key to a successful oracle narrative reporting implementation.

- Start with a template: Use the platform’s built-in templates for common reports like annual and budget books. Customize from a proven foundation rather than starting from scratch.

- Define clear roles and workflows: Assigning roles (owner, author, reviewer, approver) eliminates confusion and streamlines the reporting cycle.

- Automate data refreshes: Connect directly to source systems like Oracle Cloud EPM or NetSuite to eliminate manual updates. Automate data rollovers to reuse content from previous periods.

- Use version control and audit trails: Every change, comment, and approval is tracked automatically, providing a complete history for compliance and audits.

- Leverage SmartView for Excel: Embed live, refreshable data from EPM applications directly into Microsoft Office documents to ensure consistency and reduce manual work.

- Train your users: Comprehensive training ensures your team can extract maximum value from the system.

- Separate data publishers from narrative authors: Allow technical experts to focus on data accuracy while writers focus on crafting the narrative.

- Combine data and narrative: The core purpose is to explain the numbers. Analyze the data and tell the story it represents to ensure key facts are not overlooked. For technical details, the official documentation is a comprehensive resource.

Designing and Managing Report Packages

The architecture of your report packages is critical for a smooth user experience and efficient process.

- Understand report package types: Design your package structure based on the specific requirements of the report, whether it’s a simple management update or a complex regulatory filing.

- Manage the number of doclets: Break large reports into manageable sections (doclets) to allow for parallel work, but avoid creating too many small doclets, which can complicate the process.

- Use variables for dynamic content: Set up variables for dates, names, and key figures that appear throughout a report. Updating a variable once changes it everywhere.

- Optimize for performance: Consider the size of the package, number of doclets, and SmartView complexity during the design phase to ensure the system remains responsive.

- Use reference doclets: For content that is referenced but not authored in the package (e.g., legal disclaimers), use reference doclets to ensure consistency and reduce maintenance.

Frequently Asked Questions about Oracle Narrative Reporting

Here are answers to some of the most common questions we receive about oracle narrative reporting and how it can benefit a business.

How does Narrative Reporting differ from traditional financial reporting tools?

Traditional financial reporting tools are excellent at processing numbers but often lack the ability to easily incorporate the narrative context—the why behind the data. They can also be limited in their collaborative capabilities.

Oracle narrative reporting is different because it is specifically designed to solve these issues:

- Context-driven: It combines quantitative data with qualitative commentary and analysis directly within the report, providing a complete picture for decision-makers.

- Built for teamwork: It provides a structured, version-controlled platform where multiple authors, reviewers, and approvers can work together on a single report simultaneously.

- Unified platform: It handles both internal management reports and external regulatory filings in one system, ensuring consistency between your internal and external storytelling.

What kind of data sources can be integrated?

Oracle narrative reporting is designed as a central reporting hub and can integrate with a wide variety of data sources to ensure reports are built on complete and current information. It connects seamlessly with:

- Oracle Cloud EPM modules (e.g., Planning, Financial Close)

- Oracle Cloud Financials

- On-premise Hyperion systems

- NetSuite ERP, allowing direct pulls of financial and operational data for a unified business view.

- Spreadsheets via SmartView, which keeps Excel models connected and refreshable.

- Native databases for other unique data requirements.

This wide range of integrations eliminates manual data transfers and ensures your reports are based on a reliable, single source of truth.

How does Oracle Narrative Reporting support data security?

Data security is a core component of oracle narrative reporting, which protects sensitive information through several key features:

- Role-based permissions: Access is strictly controlled based on user roles (e.g., Owner, Author, Reviewer). This ensures users only have the permissions necessary for their tasks.

- Section-level access control: Within a report, access can be restricted to specific sections (doclets), protecting sensitive content from unauthorized viewing or editing.

- Secure review cycles: The entire review and approval process occurs within the secure platform, avoiding the risks of emailing sensitive attachments.

- Centralized data management: By pulling data directly from secure source systems, the platform reduces the risk of data leaks associated with manual transfers.

- Comprehensive audit trails: Every action—from data refreshes to content edits and approvals—is logged, creating a complete, auditable history of the report’s lifecycle for full transparency and accountability.

Conclusion: Tell the Complete Story Behind Your Numbers

In today’s business world, simply presenting numbers isn’t enough. The ability to tell a complete, compelling story with that data is what sets successful companies apart. This is where Oracle narrative reporting excels, changing raw figures into a powerful financial narrative.

By leveraging Oracle narrative reporting, you gain a competitive edge through smarter, data-driven decisions, improved transparency, and greater trust in your financial reporting. This solution streamlines processes, improves team collaboration, ensures data integrity, and helps meet complex regulatory requirements—all while providing the vital context that traditional reporting lacks.

At Nuage, we are passionate about helping businesses steer modern financial management. Whether you’re looking to optimize your NetSuite environment or integrate powerful tools like Oracle narrative reporting, our mission is to empower you to tell the whole story of your business with confidence.

Ready to transform your financial reporting? Let’s connect. Take the first step on your NetSuite journey with us, and let’s build a more insightful future for your business, together.