Bridging the Gap: Finance and Operations in Batch Manufacturing

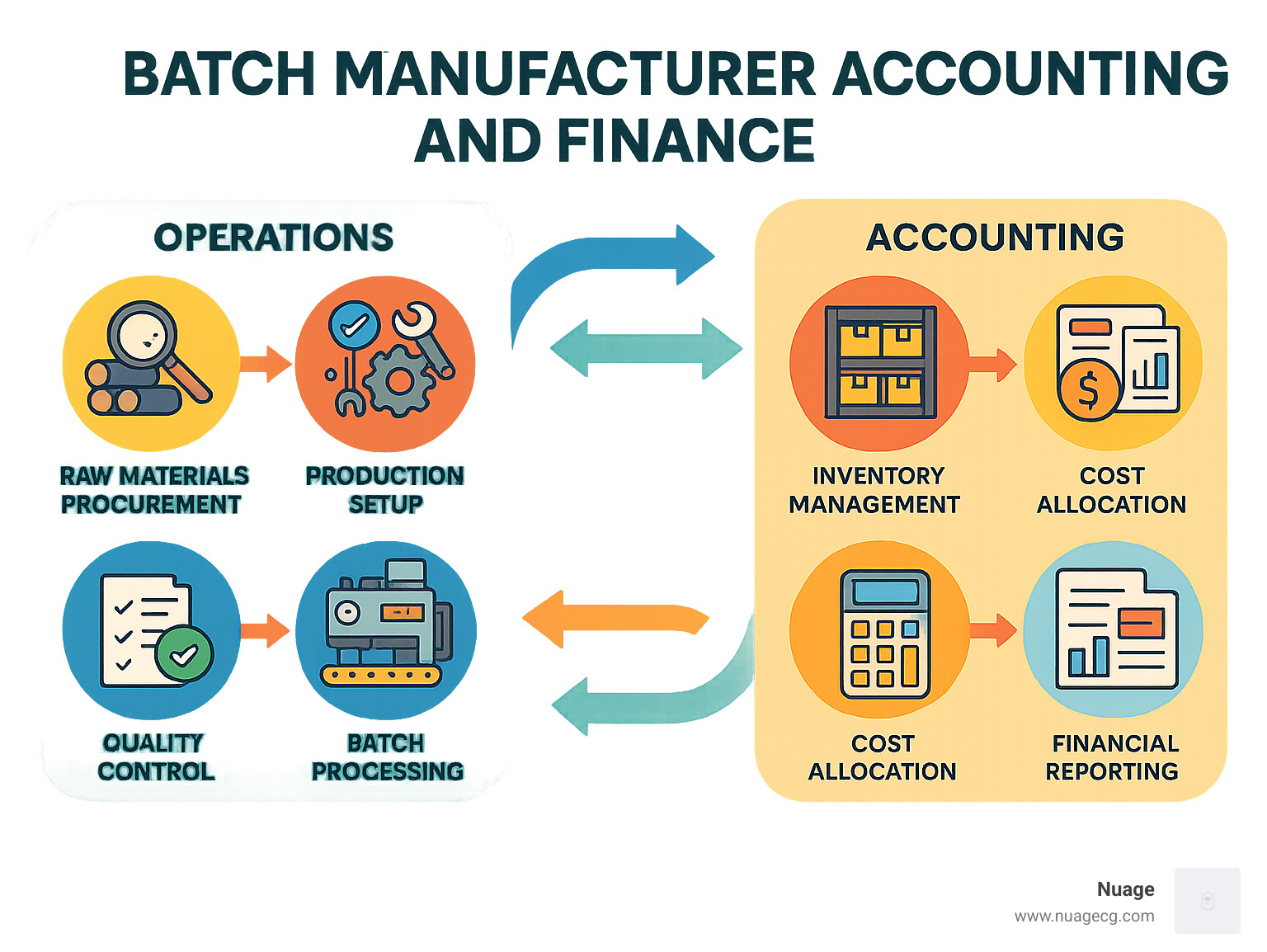

Batch Manufacturer Accounting and Finance is a specialized discipline focusing on tracking costs, managing inventory, and reporting financials for companies that produce goods in discrete groups rather than continuous flows. Here’s what you need to know:

| Key Element | Description |

|---|---|

| Unique Challenges | Setup costs, work-in-progress valuation, overhead allocation |

| Costing Methods | Job costing, process costing, activity-based costing |

| Critical Metrics | COGM, COGS, batch-level variances, inventory turns |

| Technology Solutions | Integrated ERP, real-time inventory tracking, automated cost allocation |

For manufacturers producing in batches, the disconnect between accounting and operations creates significant challenges. When production runs products in discrete groups, traditional accounting systems often struggle to accurately track costs, allocate overhead, and value work-in-progress inventory.

This disconnect isn’t just an accounting headache — it directly impacts your bottom line. Inaccurate costing leads to pricing errors, inventory valuation problems, and missed opportunities for process improvement.

The core issue? Most accounting systems weren’t designed with batch manufacturing’s unique cycles and cost flows in mind.

According to a recent National Association of Manufacturers study, manufacturing companies spend over 2,000 labor hours annually just complying with various regulations — time that could be better spent optimizing production and finances.

I’m Louis Balla, CRO and partner at Nuage, with over 15 years of experience helping batch manufacturers transform their accounting and finance processes through integrated NetSuite and IFS Cloud ERP implementations.

Batch Manufacturer Accounting and Finance terms made easy:

– ERP software for batch manufacturing

– ERP software for food industry

– digital change for manufacturers

Batch Manufacturing 101: Cycles, Set-Ups & How It Differs From Continuous Flow

Ever watched cookies come out of an industrial bakery? That’s batch manufacturing in action—groups of identical products moving through production stages together before the next batch begins. Unlike continuous flow manufacturing (think paper mills or oil refineries running 24/7), batch production works in distinct cycles with clear start and finish points.

“In the vast landscape of manufacturing processes, each with its own merits and drawbacks, batch production stands out as a popular and time-tested method,” notes industry expert Eric Kimberling.

Think of a craft brewery making a batch of summer ale before switching to autumn porter. Each batch follows the same journey—brewing, fermenting, filtering, and packaging—as a group. When one batch finishes, equipment gets cleaned and reconfigured for the next recipe.

What makes batch manufacturing special? First, there’s the flexibility to make different products on the same equipment. Your food company might produce strawberry jam on Monday and orange marmalade on Tuesday using identical kettles and filling lines.

Then there’s the setup and changeover periods—the time between batches when you’re cleaning equipment, adjusting settings, and preparing for the next run. These aren’t producing anything, but they’re essential and costly.

Work-in-progress queues are another hallmark of batch production. You’ll often see batches waiting for their turn at the next production stage, like freshly molded plastic parts cooling before moving to assembly.

Many manufacturers choose batch production for its economies of scale. By spreading fixed setup costs across all units in a batch, each individual product bears less overhead. Make 1,000 units instead of 100, and your per-unit setup cost drops dramatically.

Key Financial Implications of Batch Cycles

The batch approach creates unique financial challenges that your accounting team needs to address:

Setup costs hit your bottom line with every product change. When your cosmetics line switches from day cream to night cream, you’ll incur significant expenses in equipment cleaning, reconfiguration, testing, and documentation. How you allocate these costs makes a huge difference in understanding true product profitability.

Idle time accounting becomes crucial during changeovers. When machines and workers aren’t actively producing, should those costs go to overhead or to specific batches? Your decision affects everything from pricing to performance metrics.

Quality testing typically happens at multiple points throughout batch production. These tests protect your customers but add costs that must be properly assigned to maintain accurate batch profitability.

Lot traceability isn’t just good practice—it’s often legally required. Each batch needs a unique identifier that follows it through production, inventory, and distribution. This traceability system is essential for quality control and potential recalls, but it adds another layer of accounting complexity.

As one pharmaceutical manufacturer finded, “The inefficiencies associated with batch processing cost our industry approximately $50 billion annually.” This staggering figure shows why proper Batch Manufacturer Accounting and Finance practices aren’t just about compliance—they directly impact your profitability.

With the right ERP system for batch manufacturing, these financial challenges become opportunities for better decision-making and improved margins. Modern solutions like IFS Cloud and NetSuite are designed to handle the unique demands of batch production environments, turning financial complexity into business clarity.

Batch Manufacturer Accounting and Finance: Core Challenges & Solutions

Batch Manufacturer Accounting and Finance isn’t just about crunching numbers—it’s about connecting the dots between what happens on your production floor and what shows up in your financial statements. Unlike other manufacturing models, batch production creates unique financial problems that require specialized approaches.

When you’re producing in batches, every production run tells its own financial story. The challenge? Making sure that story gets accurately translated into your accounting system. At Nuage, we’ve helped dozens of manufacturers tackle these core challenges:

| Challenge | Description | Solution |

|---|---|---|

| Overhead Allocation | Determining how to distribute fixed costs across batches of varying sizes | Activity-based costing with batch-level cost drivers |

| WIP Valuation | Accurately valuing partially completed batches | Percentage-of-completion method with real-time data capture |

| Regulatory Compliance | Meeting industry-specific requirements (FDA, etc.) | Integrated lot tracking and electronic batch records |

| Multi-Currency Operations | Managing global supply chains and sales | Automated exchange rate adjustments and consolidated reporting |

Batch Manufacturer Accounting and Finance Pain Points

Have you ever felt like your production team and finance department are speaking completely different languages? You’re not alone. In our 20+ years helping manufacturers, we’ve seen these pain points come up again and again:

-

Data silos between production and finance: When your shop floor data doesn’t automatically flow to your accounting system, someone has to bridge that gap manually—often with messy, error-prone results.

-

Spreadsheet dependency: We once worked with a food manufacturer tracking 200+ batches across 15 different spreadsheets. Not only was it time-consuming, but one formula error led to a $50,000 costing mistake!

-

Variance blindness: Without real-time visibility, cost variances often stay hidden until month-end close. As one client put it: “By the time we finded we had a problem with raw material waste, we’d already run 27 more batches with the same issue.”

-

Inventory accuracy challenges: When you have materials in multiple states—raw, in-process, and finished—keeping an accurate count becomes exponentially more difficult.

One manufacturing controller summed it up perfectly: “Before implementing an integrated ERP, we were basically flying blind for 29 days of the month, then scrambling to figure out what happened in the previous month. It was reactive, not proactive.”

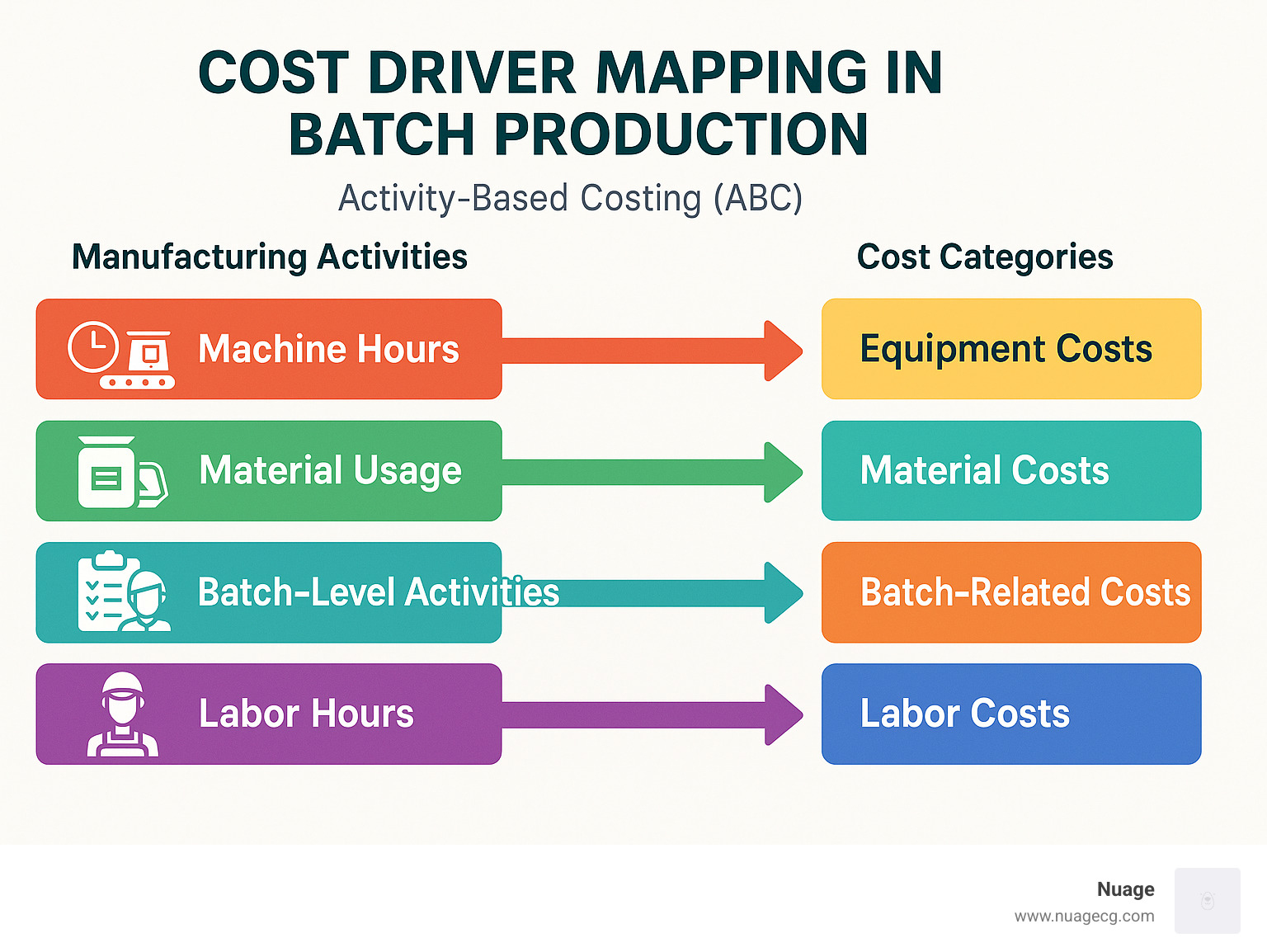

Turning Chaos Into Control With Cost Drivers

Think of cost drivers as the “why” behind your expenses. In batch manufacturing, understanding these drivers is the difference between rough estimates and precise costing.

The most effective batch manufacturers we work with focus on tracking these key cost drivers:

Machine hours reveal the true cost of equipment time, including maintenance and depreciation. Material usage helps identify waste and efficiency opportunities. Batch-level activities like setup, cleaning, and testing often hide significant costs that get overlooked. And labor hours—both direct and indirect—can vary dramatically between batches of the same product.

Activity-based costing (ABC) works wonderfully for batch manufacturers because it recognizes that many costs aren’t tied to volume alone. As one client told us after implementing NetSuite’s Advanced Manufacturing module: “We finded our smallest batches were actually more profitable than we thought, while our largest ones were eating into margins due to handling and storage costs we hadn’t properly allocated.”

Modern ERP solutions like IFS Cloud are designed with these batch-specific challenges in mind, creating a digital thread that connects production events directly to financial outcomes—no translation needed.

Building a Robust Costing Framework

When your products move through production in batches, you need a costing framework that captures every dollar accurately. Let’s break down the essential cost components that make or break your batch manufacturing profitability:

Direct Materials

These are the raw ingredients that physically become your finished product. For batch manufacturers, getting this right means tracking materials with precision:

Raw material costs vary widely between batches? That’s normal. What matters is having systems that capture lot-specific material costs, calculate actual yields (not theoretical ones), and identify where material waste happens.

“The difference between theoretical and actual yield can make or break profitability in batch production,” shared one of our food manufacturing clients who finded a 7% yield gap was costing them over $200,000 annually.

Direct Labor

The hands-on workforce directly making your products represents a significant cost center. In the batch world, labor tracking gets complicated because:

Your team spends time setting up equipment before production starts, changing over between product types, and handling non-productive but necessary tasks like cleaning and documentation. All these hours need proper allocation to the right batches.

Variable Overhead

These costs rise and fall with your production volume and include your utilities directly tied to production, consumable supplies that don’t become part of the product, and maintenance costs that increase with machine usage.

Fixed Overhead

These costs stay constant regardless of whether you produce one batch or twenty:

Your facility costs like rent and property taxes, equipment depreciation, management salaries, and those ever-present regulatory compliance costs all need fair allocation across your production batches.

Step-Fixed Costs

This often-overlooked category is particularly important for batch manufacturers. These costs remain fixed within certain production ranges but “step up” when you cross thresholds:

When you add another shift, you need supervisors. When you reach capacity, you need new equipment. As testing requirements grow, you need more QC personnel. These aren’t purely variable or fixed—they step up at certain points.

By-Products and Scrap/Rework

Batch manufacturing rarely achieves 100% conversion of inputs to intended outputs:

Some processes create valuable by-products that can be sold. Materials that don’t meet specs might be recyclable scrap with recovery value. And sometimes, products need rework to meet standards—adding costs that need tracking.

A pharmaceutical client was treating a valuable by-product as waste until our NetSuite implementation helped them recognize and track its $350,000 annual value.

Choosing the Right Production Costing Method

The costing method you select needs to match your production reality:

Job Costing works beautifully for unique, custom batches—like specialty chemicals made to customer specifications—providing precise tracking for each batch, though it requires more administrative effort.

Process Costing fits standardized batch production with minimal variation—like food production with consistent recipes—offering simplified allocation with less precision for variable batches.

Activity-Based Costing (ABC) excels in complex environments with diverse products and significant overhead—like pharmaceuticals with extensive testing requirements—allocating overhead based on actual activities rather than arbitrary measures.

Standard Costing serves stable production environments with predictable costs—like consumer packaged goods with established recipes—enabling variance analysis while simplifying inventory valuation.

Hybrid Models offer flexibility when your operation has characteristics of multiple production types—like manufacturers with both standard and custom products—though they’re more complex to administer.

For more detailed explanations of these methods, check out this comprehensive guide to product costing methods.

Calculating COGM & COGS in a Batch World

Two critical metrics form the backbone of Batch Manufacturer Accounting and Finance:

COGM Formula:

COGM = Beginning WIP Inventory + Manufacturing Costs - Ending WIP Inventory

COGS Formula:

COGS = Beginning Finished Goods Inventory + COGM - Ending Finished Goods Inventory

For batch producers, these seemingly simple formulas get complicated by partially completed batches at period end, multiple batches at different production stages, and varying batch sizes and costs.

Watch out for these common mistakes:

- Improperly valuing work-in-progress inventory

- Inconsistently allocating overhead costs

- Not adjusting for yield variations between batches

- Overlooking quality testing and rework costs

- Incorrectly treating by-products and waste

“We were calculating COGS by simply dividing monthly costs by units produced,” admitted a controller at a food manufacturer. “This completely ignored inventory changes and created wild margin swings. Implementing proper COGM and COGS calculations with IFS Cloud stabilized our financial reporting and revealed which product lines were truly profitable.”

Inventory Valuation & Control for Batch Environments

Keeping track of inventory is like solving a puzzle where the pieces keep changing shape. For batch manufacturers, this puzzle is particularly complex – you’ve got raw materials coming in, work-in-process moving through various stages, and finished goods waiting to ship, all at different values and completion levels.

Inventory Valuation Methods

When it comes to valuing all this inventory, batch manufacturers have four main options to choose from:

First-In, First-Out (FIFO) works on the principle that your oldest inventory gets used or sold first. This method often makes the most sense for batch manufacturers with perishable ingredients or materials that can degrade over time. It keeps your balance sheet values closer to current market prices, though it does require more detailed tracking to maintain accuracy across multiple batches.

Last-In, First-Out (LIFO) assumes your newest inventory goes out the door first. While this can offer tax advantages during inflationary periods (you’re expensing your highest-cost items first), it creates a practical challenge for batch manufacturers – older inventory can get “stuck” in your system, potentially leading to obsolescence or expiration issues.

Weighted Average Cost (WAC) takes the middle road by calculating an average cost across similar inventory items. For many batch manufacturers, this provides a reasonable balance between accuracy and administrative simplicity. It’s particularly useful when you’re running multiple similar batches with slight cost variations.

Specific Identification is the gold standard for accuracy – you track the actual cost of each specific item in inventory. For pharmaceutical or specialty chemical manufacturers where regulatory compliance demands precise batch tracking, this method makes sense despite the additional administrative overhead.

Beyond these valuation methods, batch manufacturers need to consider:

- Safety Stock levels to buffer against supply chain disruptions

- Serial/Lot Tracking systems that follow materials from receipt through production

- Expiry Date Management to prevent costly waste and compliance issues

“Perpetual inventory systems are ideal for large, complex manufacturers,” notes an industry expert. I’d go further – they’re not just ideal but essential for batch manufacturers who need that real-time visibility.

Real-Time WIP & Finished Goods Visibility

Gaining clear sight into your inventory status at any moment requires bridging the gap between what’s happening on the production floor and what’s recorded in your financial systems. The technologies making this possible include:

Barcoding and RFID tags that travel with materials and batches, creating digital breadcrumbs throughout the production process. These simple tools eliminate manual data entry and dramatically improve accuracy.

Manufacturing Execution Systems (MES) capture production data as it happens, tracking yields, material consumption, and batch status in real-time.

Cycle Counting replaces disruptive annual inventory counts with regular, targeted counts of specific items. This approach is particularly valuable for batch manufacturers who can’t afford production shutdowns.

Integrated ERP systems serve as the backbone, connecting shop floor activities with accounting records. ERP software for batch manufacturing eliminates the data silos that plague many manufacturers and provides a single source of truth for both operations and finance teams.

Cash-Flow Impact of Excess Inventory

Every batch sitting in your warehouse represents cash that’s not in your bank account. For batch manufacturers, excess inventory creates a cascade of financial effects:

Working Capital Requirements increase as inventory levels rise, tying up funds that could be invested in growth, equipment upgrades, or returned to shareholders. This hidden cost of inventory is often overlooked until cash flow becomes tight.

Carrying Costs add up quickly – storage space, insurance premiums, property taxes on inventory, and the labor needed to manage it all. Industry estimates put these costs at 15-30% of inventory value annually.

Spoilage and Expiration risks are particularly acute for food, pharmaceutical, and chemical manufacturers. One client told me, “Every expired batch is like taking cash and throwing it directly into the trash.”

Demand Forecasting accuracy directly impacts inventory needs. Better forecasts mean less safety stock and lower overall inventory levels.

A food manufacturer we worked with at Nuage finded they were carrying three months of inventory for ingredients with a one-month shelf life. This mismatch led to significant waste and cash flow problems. After implementing real-time inventory tracking connected to their Batch Manufacturer Accounting and Finance systems and improving their forecasting processes, they reduced inventory by 40% and nearly eliminated waste due to expiration. The freed-up cash allowed them to invest in new production equipment that further improved efficiency.

The right inventory approach isn’t just about accurate financial statements – it’s about creating a healthier, more resilient business that can weather supply chain disruptions while maximizing cash flow.

Technology Stack: ERP & Automation That Close the Books Faster

Today’s batch manufacturers are finding that the right technology can transform their accounting and finance operations from a monthly scramble into a smooth, real-time process. Modern solutions aren’t just changing how we track costs—they’re revolutionizing the entire Batch Manufacturer Accounting and Finance landscape.

Gone are the days of waiting until month-end to find costly variances or inventory discrepancies. With the right tech stack, you can close your books faster while gaining unprecedented visibility into your operations.

The foundation of this change starts with robust Enterprise Resource Planning (ERP) systems like IFS Cloud and NetSuite with their specialized manufacturing capabilities. These systems serve as the backbone that connects every aspect of your operation.

But ERP is just the beginning. Manufacturing Execution Systems (MES) bridge the gap between your ERP and the shop floor, capturing real-time production data that feeds directly into your financial systems. When your accountants can see actual production metrics as they happen, they can address issues immediately rather than weeks later.

The tech revolution extends to the equipment itself through IoT sensors and automation. Imagine material usage, machine time, and quality metrics automatically flowing into your costing system without manual data entry. One food manufacturer we worked with reduced cost calculation errors by 87% after implementing automated data collection.

Tying everything together are powerful integration technologies like APIs and data warehouses that ensure your operational and financial systems speak the same language. And with mobile solutions like barcode scanners and tablet-based data entry, your team can update information from anywhere on the production floor.

“Before implementing these technologies, our month-end close felt like an archaeological dig,” laughed one manufacturing controller we worked with. “We were constantly uncovering surprises from weeks ago. Now we have real-time visibility that lets us be proactive instead of reactive.”

Why NetSuite & IFS Lead for Batch Finance

When it comes to Batch Manufacturer Accounting and Finance, not all ERP systems are created equal. NetSuite and IFS Cloud have emerged as leaders because they understand the unique challenges batch manufacturers face.

NetSuite Advanced Manufacturing shines with its finite capacity scheduling that optimizes production planning around your actual constraints—crucial for managing multiple batches competing for the same resources. Its integrated general ledger means financial transactions automatically flow from shop floor activities, eliminating the data silos that plague many manufacturers.

For companies in regulated industries, NetSuite’s built-in compliance features are a game-changer. And its multi-entity support handles complex organizational structures with ease. The system’s recipe and formula management is particularly valuable for batch/process industries where precise formulations drive quality and cost.

Want to learn more about financial planning in NetSuite? Check out our guide to NetSuite Budgeting and Forecasting.

IFS Cloud takes a different but equally powerful approach with comprehensive end-to-end batch management. Its advanced planning and scheduling capabilities help you maximize equipment utilization while minimizing changeover times. The robust quality management system integrates directly with financial reporting, so quality costs are properly allocated.

One feature that sets IFS apart is its integrated maintenance management, which helps you balance preventive maintenance costs against production schedules. And with multi-currency support built into its financial core, global manufacturers can consolidate results across borders with confidence.

Find IFS Cloud’s full range of capabilities in our detailed IFS Cloud overview.

Implementing ERP Without Disrupting Production

The thought of implementing a new ERP system often strikes fear in the hearts of manufacturing leaders. “Will we have to shut down production?” “What if we lose data?” These concerns are valid, but with the right approach, you can transform your systems without disrupting your production flow.

Based on our two decades of experience at Nuage, the key to success is a phased rollout approach. Rather than a “big bang” implementation, start with core financials and gradually add manufacturing modules. Schedule major cutover activities during planned downtime between batch runs. Some clients even maintain parallel systems during the transition to minimize risk.

Data cleansing and migration is where many implementations stumble. Take the time to validate your bill of materials and routing data before migration. Conduct physical inventory counts to ensure opening balances are accurate. One chemical manufacturer we worked with finded thousands in phantom inventory during this process—a painful but valuable finding before go-live.

Never underestimate the importance of user training and adoption. The most powerful system in the world won’t help if your team doesn’t know how to use it effectively. We recommend role-based training focused on daily tasks, with champions in each department who can support their peers. Hands-on practice with real scenarios is far more effective than generic classroom training.

Finally, thoughtful change management makes all the difference. Clear communication about the implementation timeline and benefits helps manage expectations. Executive sponsorship signals the importance of the project to everyone in the organization. And creating feedback mechanisms allows you to address concerns before they become obstacles.

For manufacturers looking to dig deeper into ERP implementation strategies, our guide to ERP for Process Manufacturing offers valuable insights specific to batch and process environments.

As one client put it: “We thought implementing a new ERP would be like changing the engine while the car was running. Instead, it felt more like adding a turbocharger—there was some adjustment, but the performance improvement made it all worthwhile.”

Financial KPIs, Reporting & Compliance Must-Haves

Let’s face it – you can’t improve what you don’t measure. For Batch Manufacturer Accounting and Finance, tracking the right metrics makes all the difference between merely surviving and truly thriving in today’s competitive landscape.

When we work with batch manufacturers at Nuage, we always emphasize the importance of monitoring these critical financial KPIs:

Gross Margin per Batch tells the true story of each production run’s profitability. Unlike overall gross margin, this batch-specific view reveals which products and formulations actually make money – and which ones silently drain your profits.

Variance Analysis highlights the differences between your standard and actual costs. These variances are like flashing warning lights on your financial dashboard, signaling when something’s gone wrong in production.

Inventory Turns measures how efficiently you’re moving inventory through production. Lower turns mean cash sitting idle in your warehouse instead of generating returns.

Factory Profit/Loss comparisons help you make smart decisions about in-house versus outsourced production. Sometimes what seems cheaper actually costs more when all factors are considered.

Cost-Volume-Profit (CVP) Break-Even analysis shows exactly how many units you need to produce to cover your fixed costs. This is particularly valuable for batch manufacturers deciding optimal batch sizes.

A chemical manufacturer we partnered with implemented a dashboard tracking batch-level variances, which revealed that certain product formulations consistently exceeded standard costs. This insight led to a reformulation that improved margins by 8% – proof that measuring the right things leads directly to better profits.

Automating Dashboards & Alerts

The days of waiting for month-end reports to make decisions are long gone. Modern ERP systems like NetSuite and IFS Cloud enable real-time visibility that transforms how you manage your batch operations.

Role-based views ensure everyone sees exactly what they need – production managers focus on efficiency metrics while financial controllers see cost variances and cash flow projections. This targeted information helps each team member make better decisions faster.

Exception reporting lets you stop wasting time reviewing normal operations and focus only on what needs attention. When a batch runs significantly over cost or production time, you’ll know immediately, not weeks later when the monthly reports come out.

Scenario planning capabilities let you model different production scenarios before committing resources. What happens if you double batch size? How would costs change with a different supplier? These what-if analyses become powerful strategic tools.

As one manufacturing controller told us, “The difference between reactive and proactive management is having the right information at the right time. Automated dashboards and alerts have transformed how we manage our batch operations, allowing us to address issues before they become problems.”

Beyond performance metrics, batch manufacturers face increasingly complex compliance requirements:

SOC/SOX Compliance demands robust internal controls and clear audit trails – particularly important for publicly traded companies or those considering an IPO.

GAAP/IFRS Adherence ensures your financial statements follow proper accounting standards, especially regarding revenue recognition and inventory valuation methods.

ESG Cost Tracking has become essential as customers, investors, and regulators focus more on environmental, social, and governance factors. Many batch manufacturers now track sustainability metrics alongside financial ones.

Industry-Specific Regulations like FDA requirements for food and pharmaceutical manufacturers or EPA guidelines for chemical producers add another layer of reporting complexity.

For deeper insights into building effective financial reports, our guide to Financial Reporting Programs provides valuable best practices and implementation strategies.

The right KPIs and automated reporting don’t just satisfy compliance requirements – they transform data into actionable intelligence that drives better business decisions every day.

Frequently Asked Questions about Batch Manufacturer Accounting and Finance

How do I allocate overhead to small versus large batches?

Overhead allocation is one of those headache-inducing puzzles in Batch Manufacturer Accounting and Finance. When you’re running both small and large batches on the same equipment, traditional volume-based methods can seriously distort your true costs.

Many manufacturers we work with initially allocate overhead based purely on volume, which makes their small batches look prohibitively expensive while their large batches appear artificially profitable. This creates a dangerous blind spot in your business decision-making.

Activity-based costing (ABC) offers a more accurate approach. Instead of dumping all overhead into one bucket, ABC identifies which activities actually drive your costs. For batch manufacturers, this means separating:

- Batch-level activities (setup, quality testing, documentation) that cost roughly the same whether you’re making 10 units or 1,000

- Unit-level activities that scale proportionally with batch size

One food manufacturer we partnered with was consistently underpricing their small-batch custom orders because their simplistic allocation method masked the true setup costs. After implementing ABC, they finded these small batches were actually losing money. Their revised pricing strategy not only stopped the bleeding but turned these specialty orders into a profitable segment.

Which inventory valuation method minimizes tax liability?

The short answer: it depends on price trends in your industry and your specific business circumstances.

During inflationary periods (when costs are rising), LIFO typically results in higher COGS and lower taxable income, potentially reducing your tax bill. When prices are falling, FIFO might give you the tax advantage. With stable prices, your method choice has minimal tax impact.

That said, choosing an inventory method solely for tax reasons is like buying a house just for the tax deduction – there are much bigger considerations at play. Your inventory method affects operational clarity, financial reporting, and administrative workload, often in more significant ways than the tax impact.

It’s also worth noting that while LIFO may offer tax advantages in the US, it’s not allowed under International Financial Reporting Standards (IFRS). If you have global operations or might someday, this could complicate your reporting.

Before making any changes to your inventory methods, sit down with a qualified tax professional. Switching methods requires IRS approval, and there may be transition impacts to consider.

Can I stay on cash-basis accounting under the $29M TCJA threshold?

Yes, technically you can – the Tax Cuts and Jobs Act of 2017 allows businesses with average annual revenue under $29 million (over the prior three years) to use cash-basis accounting for tax purposes. This might seem like a welcome simplification for smaller batch manufacturers.

However, there’s a big difference between what’s permitted for tax reporting and what actually helps you run a better manufacturing business. Cash-basis accounting simply doesn’t provide the insights batch manufacturers need because it fails to properly match revenues with production costs.

With cash accounting, you’d struggle to:

– Calculate accurate product profitability

– Properly value your inventory

– Analyze how specific batches performed

– Make informed pricing decisions based on true costs

Most successful batch manufacturers we work with use accrual accounting for management purposes, even if they opt for cash-basis for tax filing. Modern ERP systems like NetSuite and IFS Cloud can support both methods simultaneously, giving you the best of both worlds – simplified tax compliance and robust management information.

At Nuage, we’ve seen manufacturers try to operate with cash-basis accounting alone, and they inevitably hit a wall when trying to make strategic decisions about pricing, product mix, or production planning. The right accounting approach is fundamental to manufacturing success.

Conclusion

Changing Batch Manufacturer Accounting and Finance from chaos to harmony isn’t just about new software—it’s about creating a seamless connection between your operations and finance teams that gives everyone a clear, unified view of your business.

Here at Nuage, we’ve spent more than two decades walking alongside manufacturers through their digital change journeys. Time and again, we’ve witnessed how bringing operational and financial data together through platforms like NetSuite and IFS Cloud can completely revolutionize how batch manufacturing businesses operate.

The rewards go far beyond just making your accounting department more efficient:

When you have accurate cost data at your fingertips, you can make truly informed strategic decisions about your product mix, pricing strategies, and whether to make components in-house or buy them. Your variance analysis will spotlight opportunities to optimize processes that you might never have noticed before. Your integrated systems ensure you stay compliant with traceability requirements and documentation standards. Perhaps most importantly, precise costing leads directly to improved margins and healthier cash flow.

As one manufacturing CFO we work with put it: “This isn’t a one-time project—it’s an ongoing evolution. Each improvement reveals new opportunities.” That’s the beauty of this journey—it continues to deliver value long after implementation.

We’ve found that manufacturers who accept this integrated approach gain a competitive edge that’s difficult for others to match. They respond faster to market changes, make better pricing decisions, and identify inefficiencies before they become problems.

We’d love to connect with you to discuss your specific challenges and explore how we can help bring your batch manufacturing operations and finance into perfect harmony. With offices in Manhattan Beach, CA and Ponte Vedra, FL, our team of experts is ready to support your change journey, no matter where you’re located.

For more information about how NetSuite can support your batch manufacturing operations, visit our NetSuite solutions page. Together, we can turn your accounting and finance challenges into your competitive advantage.